Independent system integrators have long played a critical role in the modern manufacturing and process industries. Over the past decade, however, they’ve moved from serving primarily as a support team for in-house engineering projects to playing higher-level roles through ongoing engineering services engagements.

To gain a better understanding of how the industry/system integrator relationship is evolving in light of today’s economic and technological changes, Automation World conducted a survey with CSIA (Control System Integrators Association). The survey revealed that, while some current aspects of the relationship do not appear to be changing significantly, other aspects indicate noteworthy changes taking place.

Let’s start with what doesn't appear to be changing much for system integrators—the workload allocation given to them on automation projects. According to survey respondents, the current typical workload allocation breaks out as follows: 49 percent given to in-house engineers, 24 percent to automation equipment vendors, 23 percent to independent system integrators, and 4 percent to “other.” Looking ahead over the next three years, respondents said that 51 percent of automation project workloads will be given to in-house engineers and 21 percent will go to automation equipment vendors. The amount of workload going to independent system integrators stayed the same.

Though no significant changes are expected to occur for system integrators as it relates to automation project workloads, the response to this set of questions does appear to indicate a change for automation equipment vendors. They appear to be in store for a small downturn in engineering services spend, which is a surprise considering the amount of effort many vendors have put into building these services over the past decade. It’s also surprising that responses indicate manufacturers and processors do not plan to reduce in-house engineer staff any further. They may even be planning to increase it.

In fact, an increase in engineering staff has already taken place at 34 percent of respondent companies in the last three years, according to the survey results. Only 14 percent noted a decrease in in-house engineering staff, while 52 percent say engineering staffing levels have remained the same.

I asked Jose Rivera, CEO of the CSIA, what he thought about this insignificant change expected for system integrators, but the potential larger impact on automation technology suppliers. “In the past decades, end users—manufacturing or process plants—have outsourced entire engineering departments and moved to have independent system integrators or automation vendors take on this role,” he said. “While this trend hasn’t stopped, it probably is over its biggest hump.”

Despite the likelihood that industry’s biggest moves toward outsourcing engineering talent may have already occurred, Rivera said end users remain challenged when it comes to recruiting engineering talent. “Engineers are a hot commodity today and young engineers have many employment options to choose from,” he said. “Given this important constraint, but also the fact that automation continues to become more complex, many end users have moved to define the areas they want to focus on in-house and are outsourcing the rest. In a recent conversation, I learned about an important food and beverage company that defines process as their ‘core’ and looks for specialist outsiders to cover other important, yet not necessarily ‘core’ areas like motion and packaging.”

One possible indication of a shift toward greater use of in-house engineering staff can be seen in responses to the question, "Regarding your use of independent system integrators, please describe the changes you've made over the last three years." Nineteen percent say they haven't used an integrator, 41 percent say their use of integrators hasn’t changed, and 15 percent say they've reduced their use of integrators. However, 25 percent have increased their use of integrators. Essentially, 75 percent of respondents have seen their use of integrators level off, go unused or decrease in the past three years.

“In-house engineering seems to be stretched to the maximum these days,” said Rivera. “If end users can hang on to their existing engineers, they will do so. Their challenge resides in replacing the retiring wave of engineers with new ones. From what I have learned, end users have been very willing to hire young engineers. The problem is that they can’t get enough engineers. Sometimes the location of manufacturing or process plants is not the most appealing to young engineers. In other cases, they must provide considerable training to young engineers to get them to deliver what is required of them in industrial automation. It seems that many young engineering graduates elect courses in areas of high demand, such as web design, but are neglecting basic automation courses like PID control.”

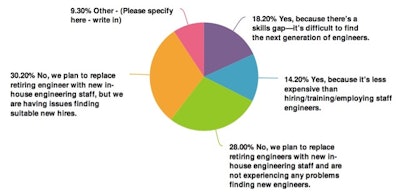

One of the more intriguing data points from the survey is found in how industry is planning to address the changes being brought about by the high levels of retirement among experienced engineering staff. Fifty-eight percent say they do not plan to replace retiring in-house engineering staff with third-party system integration services; 32 percent plan to replace retiring engineers with system integrators services. Of the 58 percent who plan to rehire in-house staff, slightly more than half are having difficulty finding suitable replacement hires.

Looking at the 32 percent who plan to replace retirees with system integrator services, 18 percent said they will make greater use of system integration services to replace retiring engineers because it’s difficult to find in-house replacements. The remaining 14 percent are inclined toward use of system integrators over in-house engineers because of the lower overall cost.

Rivera said he is not surprised with the results shown by the survey in this area. “We have a serious deficit of good engineers in the industrial automation market and don’t anticipate this problem to go away anytime soon,” he said. “Leveraging the services provided by system integrators is a good sound practice. At a recent conference, I heard an end user comment about their positive experience working with system integrators. The plant was at a remote site and they simply could not find interested engineers to join them. So they arranged an engagement with a system integrator that gave this plant priority availability—within 2 hours—of engineering help from the integrator. More importantly, the plant also got a weekly visit from the integrator to work on key assignments. In this case, the integrator handles part of the work remotely. This way the integrator’s engineers can be leveraged across multiple customers and continue to develop their expertise. For the end user, their challenge was the required change management by internal engineers to accept the external resource. Because of the good work results the end user received from this arrangement, this challenge has been resolved.”