For years, big food and beverage processors have been investing heavily in new technology for their plants. The 2017 Evolution of Automation report from PMMI, The Association for Packaging and Processing Technologies, shows not only is that trend not reversing, but growing and spreading.

What’s driving automation

The report identifies six key trends driving plant floor automation:

- Lack of skilled labor and labor shortages: The staffing challenge facing food and beverage processors is double-fold. There is a smaller pool of laborers with the right skills to choose from, while droves of baby boomers are retiring from the manufacturing workforce.

- Global increase in product demand: The world’s population continues to grow, which means more food and beverage products are being shipped farther.

- Rising demand for flexible manufacturing: Consumer tastes and needs are changing rapidly, which means processors must employ flexible processes.

- Producing products with consistent quality: Consumers expect food and beverage products to be high quality and safe every time they are consumed.

- Overall operating cost reductions: To keep costs down, processors are looking to optimize all processing procedures.

- Smart machine technology and co-bots: New ways of processing are being enabled by new technology, including artificial intelligence and collaborative robots that are designed to work side by side humans.

A number of food and beverage processors reported having these challenges and seeing automation as a solution. As one plant manager for a meat processing plant says, “In 20 years our plant will be 100 percent automated and IIoT deployed and active.”

Moreover, an increasing number of smaller food and beverage processors are using automation to grow their business.

“Increasing utilization of OEE is a 10-year goal. We will get a user interface, achieve CIP and have remote connectivity in the next five years,” says a production manager for a small food company.

Challenges for the road ahead

Increasing the use of advanced automation in plants is just the first step in a long process for processors. The PMMI report also identified a number of challenges facing food and beverage manufacturers when having access to vast amounts of data:

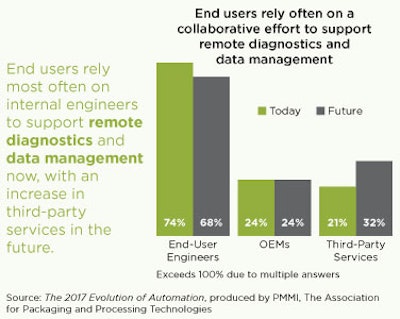

1. Lack of skilled resources: As previously discussed, finding experienced, skilled people to help obtain and properly analyze data is a challenge. One way that some processors are overcoming this is using remote connectivity with third parties to assist their internal engineers (see chart).

2. Out-of-date software models: If a plant is using old software, it could, at best, inhibit the ability to perform tasks. At worst, dated software could leave plants vulnerable to security risks.

3. Inadequate IT infrastructure: Collaboration is cited as one of the most important ways to improve IT, with IT and OT departments needing to unify networks and systems with one communication protocol to reap the benefits of a smarter plant floor. Fifty-eight percent of the report’s participants say a collaborative environment is evolving, but that it takes time. Almost 43 percent of the companies polled say their IT and OT departments already work together on special projects.

4. Absence of data standards: Again, more collaboration to create industry data standards as well as the willingness to communicate best practices between businesses may be needed to address the gap in data standards.

5. Obsolete data management systems: The ability to analyze data depends on the quality of data being gathered. Thus, new data management systems might be needed.

As briefly mentioned above, another key trend that has been identified by the PMMI report is an increased deployment of and reliance on remote connectivity in food and beverage plants (see box). Respondents say there are a number of factors driving this, but the No. 1 reason is for faster downtime recovery. Fifty-six percent of the people polled say they want more remote connectivity in their plants to help get their lines back up and running when something goes wrong.

The second most popular reason is for decreased travel costs. The amount of money spent to get outside help to your plant can add up, and 46 percent of the respondents say remote connectivity is important in cutting those expenses. Other reasons for processors increasingly relying on and allowing more remote access to their plants are the smaller size of plants’ engineering departments as well as a lack of internal skilled staff.

For the future

While all signs point to more plants investing in advanced automation, the challenges are also likely to continue to grow. However, the PMMI report does offer some strategies for tackling future hurdles.

First, processors should understand the technology available to them and how to take full advantage of it. Far too often, new systems, software and/or equipment are installed in plants, and operators do not or cannot fully optimize them. Making sure all staff members interacting with the new technology are properly trained can be key to operational efficiency.

Another way to make sure cutting-edge equipment is properly used is to obtain qualified engineers and technicians to operate and maintain these smarter machines. To help recruitment efforts and retain skilled workers, processors should ensure their plants are desirable places to work.

And finally, putting in place leading cybersecurity measures have to be prioritized and should be part of an ongoing effort to keep plants secure. Implementing new data and system security should be done to minimize the enormous risk manufacturers are facing in this new digital age.