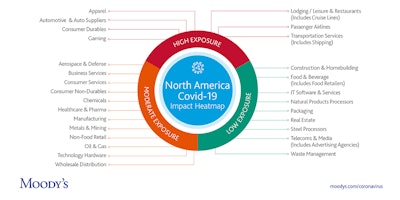

Business and financial services company Moody’s has released a report in which it provides a heatmap of the level to which North American industries will be economically affected by the coronavirus pandemic. Among those identified as having Low Exposure—in both Moody’s baseline and downside scenarios—are food and beverage, packaging, telecommunications, and waste management, all of which provide essential goods and services. Grocery stores, for example, have remained open even in heavily-restricted containment zones in Italy, China, and the U.S., notes the report.

According to the Moody’s Investors Service report, which was published last week, the spread of the coronavirus will negatively impact around 16% of North American companies under its baseline economic scenario, but under its downside scenario, that figure will jump to about 45%. Moody’s baseline scenario assumes a normalization of economic activity in the second half of 2020, while its downside scenario sees the number of COVID-19 cases surge, and fears that the virus won’t be quickly contained leading to extensive travel restrictions and quarantines, as well as a protracted slump in commodity prices.

Says Moody’s, “Our forecasts remain highly uncertain at this point.”

Listen to these PMMI UnPACKed with PMMI podcasts on packaging suppliers’ operational best practices for dealing with the pandemic:

OEM Covid-19 Response #1: ProMach, Inc.

OEM Covid-19 Response #2: Pearson Packaging Systems

OEM Covid-19 Response #3: Polypack, Inc. & Garvey Corp.

OEM Covid-19 Response #4: Morrison Container & F.R. Drake

“Under our baseline scenario, waning travel and tourism and reduced discretionary spending would hurt mainly passenger airlines, auto suppliers, apparel, gaming, lodging and leisure, and transportation companies,” says Benjamin Nelson, a Moody’s Vice President – Senior Credit Officer and co-author of the report. “However, recession risks are rising as Coronavirus spreads around the world.”

Moody’s baseline scenario assumes coronavirus infections rise through the second quarter, leading to travel restrictions, quarantines, and closures of schools, factories, and businesses in the most affected countries. Monetary and fiscal measures will help support the global economy later in 2020.

Under Moody’s downside scenario, monetary and fiscal stimulus won’t be sufficient to buoy the global economy, and certain key economies would fall into recession, leaving sectors such as oil and gas, manufacturing, and chemicals vulnerable to extensive and prolonged travel restrictions, quarantines, and multi-regional closures of schools, factories, and businesses. Market access likely would become choppy, making it more difficult for companies to address urgent liquidity needs and upcoming debt maturities.

The rating agency’s heatmap of sector exposure shows that liquidity could be a significant concern for aerospace, apparel, consumer nondurables, and mining companies.

See more information on research and ratings affected by the coronavirus outbreak here.

See PMMI's Coronavirus response resources by clicking here.